What Is Condo Insurance and What Does It Cover?

A condo can be an ideal investment for people seeking a low-maintenance lifestyle with the benefits of homeownership. You don’t own the building, so you don’t have to worry about replacing the roof or mowing the lawn while you live there. When purchasing a condo, it’s important to understand all the costs involved, including condo insurance.

This May Also Interest You: How Much Does Homeowners Insurance Cost?

Condo insurance is a bit different than renters or homeowners insurance. If you’re in the market for a condo, this guide should tell you everything you need to know about condo insurance.

What Is Condo Insurance?

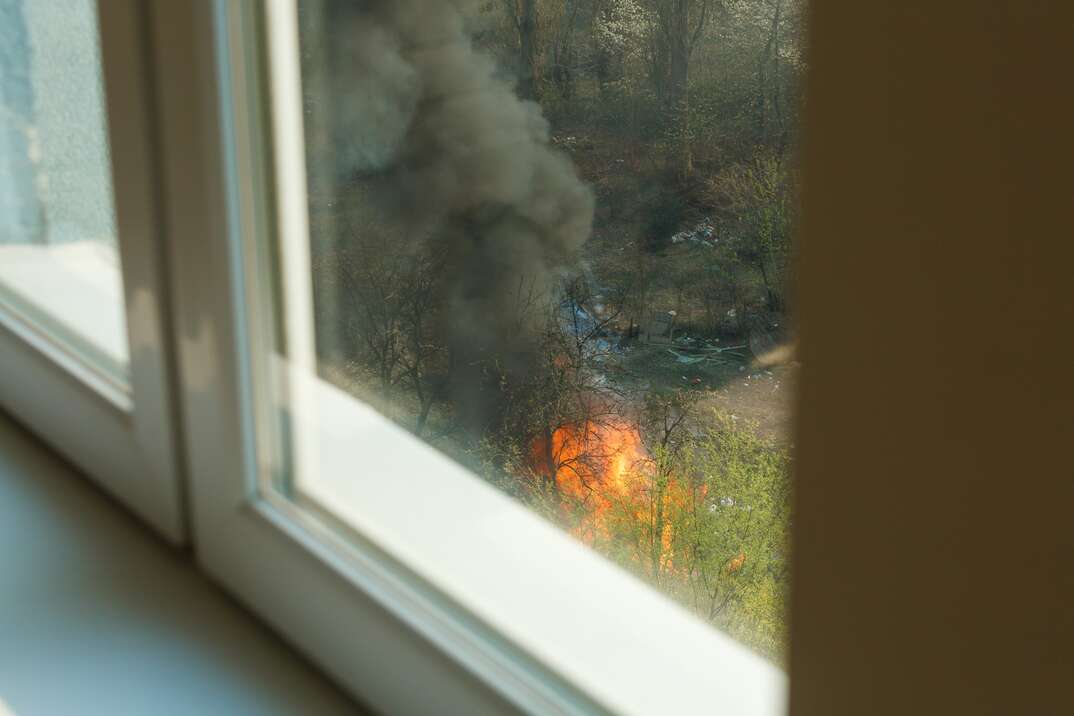

Condo insurance — also referred to as HO-6 insurance — is a standard policy that is specifically designed for condo unit owners. Condo insurance only provides protection in the event of a catastrophic event, such as fire, theft, vandalism or accident. Typically, condo insurance only covers damages that occur inside the unit.

What Does Condo Insurance Cover?

Condominium insurance provides a variety of protections, including:

- Building Property: Covers walls, floors and other in-unit features

- Personal Property: Covers personal property, including clothing, jewelry and electronics

- Loss of Use: Covers the cost of lodging in the event you are unable to stay in your condo

- Personal Liability: Provides protection against lawsuits in the event someone is injured while in your unit

How Does Condo Insurance Differ From Homeowners Insurance?

The major difference between homeowners and condo insurance is what areas of the property are covered under the policy. For example, homeowners insurance typically covers the entire structure, including floors, walls and roofs. Condo insurance, on the other hand, only provides “walls-in” coverage for each specific unit.

What Does ‘Walls-In’ Mean in Reference to Condo Insurance?

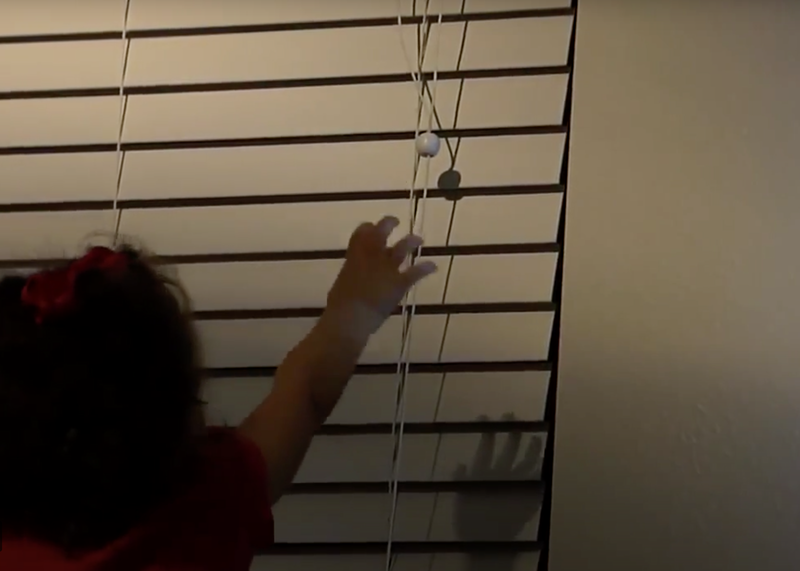

Since the condo association’s insurance policy often covers common areas — including lobbies, swimming pools and roofs, — your condo insurance strictly covers the interior walls of the unit and the contents, structure and non-built-in features of the unit. This type of coverage is referred to as “walls-in” insurance.

What Does the Homeowners Association Cover?

The homeowners association of your condominium should maintain separate insurance protection that covers all common areas, such as roofs, parking garages and hallways. This insurance may or may not cover some built-in features within the unit, such as built-in bookcases.

More Related Articles:

- What’s the Difference Between a Home Warranty and Home Insurance?

- What Does Homeowners Insurance Cover … and What Doesn’t It?

- How to Do a Home Inventory Before Disaster Strikes

- Does Homeowners Insurance Cover Plumbing Repairs?

- Got Plumbing Problems? Here’s What Issues Homeowners Insurance Covers … and What It Doesn’t

How Much Does Condo Insurance Cost?

Condo insurance varies greatly in cost based on location and coverage needs, but policies typically cost somewhere between $250 and $750 per year, according to This Old House. Annual costs could exceed this amount if supplemental coverage, such as flood insurance, is needed.

How Much Condo Insurance Do You Need?

The amount of condo insurance protection you need depends on several factors, including:

- Type of coverage provided by condo’s homeowner’s association

- Amount of coverage required by your HOA

- Size and value of the condo

- Location

- Type of personal property included

How to Calculate How Much Condo Insurance You Need

When calculating how much condo insurance you need, be sure to request the declaration page of your HOA’s insurance policy to determine exactly what it covers. Additionally, review your HOA’s policies to see what type of coverage you are required to maintain.

Who Is Liable if Damage is Caused by One Unit to Another?

In most cases, the condo owner causing the damage is liable. For example, if the sink in an upstairs condo overflows and causes damages to the condo beneath it, the upstairs condo owner is responsible for the damage. If, however, the water damage is caused by issues with common areas, such as a leaky roof, the HOA would be responsible for the damages.

Is Condo Insurance Part of Your Mortgage Payment?

Nearly all lenders require condo owners to maintain some level of condominium insurance. In many cases, these lenders will calculate this insurance coverage into your monthly mortgage payment to ensure they are paid on time.