First-Time Home Buyers: 3 Moves to Make (and 3 Mistakes Not To)

Buying your first home is a major achievement and an exciting time. However, many first-time home buyers make mistakes that could cost them money and cause problems during the buying process.

This May Also Interest You: What to Expect When They’re Inspecting: Your Home-Inspection Checklist

Fortunately, following a few simple tips can help you avoid these pitfalls and purchase your dream home as affordably — and quickly — as possible.

What Are Some Common Mistakes Made by First-Time Home Buyers?

Knowing some of the common first-time home buyer mistakes can help you know what to avoid and make the process far less daunting. Here are some of the things you should avoid doing:

1. Failing to Get Pre-Approved

Pre-approval can seem like a dauntingly complex process, so many first-time home buyers choose to skip it and move straight to the fun part — choosing their first home.

Note: Pre-approval is not the same as pre-qualification. Pre-qualification is a quick way to get an idea of how much you could potentially borrow, but there's no guarantee you'll be able to secure a mortgage for that amount.

Pre-approval involves a far more detailed analysis of your finances and credit record to come up with a realistic mortgage amount. Some providers will provisionally agree to lend you the money based on pre-approval.

There are a couple of good reasons why it's a bad idea to put pre-approval on the back burner. First, you won't have as clear an idea of your budget, even if you are pre-qualified, because you may ultimately be approved for a lower amount. It may also make you a less attractive choice to vendors if you can't prove you've been approved for a certain mortgage amount. They may feel that it's too risky to sell to you.

2. Overstretching Yourself Financially

Failing to consider how much you can realistically afford to pay toward a mortgage each month is a common first-time home buyer mistake. A mortgage is a major financial commitment, and it will probably be your biggest outgoing expense. Just because you've been pre-approved or pre-qualified for a large mortgage doesn't mean you can afford to repay it while enjoying a decent quality of life and saving money for emergencies.

Another way that many buyers overstretch themselves is by buying a house while having significant amounts of existing debt. Repaying other debts can make it harder to keep up with mortgage repayments, and keep in mind that you’ll have to come up with more money for home repairs if they’re needed down the line.

3. Choosing the Wrong Mortgage or Provider

Many first-time home buyers don't shop around enough before choosing a mortgage or provider. Choosing a mortgage is an important decision because it affects how much interest you repay and covers your biggest financial asset.

A decent lender will talk you through your options and be transparent about the costs, benefits and drawbacks of every product they suggest. Back away from any mortgage provider that isn't prepared to put in the time to make sure you understand your options and commitments.

Many people choosing their first home mortgage make the mistake of choosing the longest possible mortgage term without considering whether a shorter term would be more affordable in the long run. A 30-year mortgage repayment plan will lower the monthly payments, but it will cost you more in interest over the loan's lifetime.

More Related Articles:

- Homeowners Vs. Renters Insurance: What’s the Difference?

- What Does Home Insurance Cover … and What Doesn’t It?

- How Much Does Homeowners Insurance Cost?

- Here’s How Much Common Home Repairs Cost — and How to Budget for Them

- What Do You Need a Property Survey for and How Much Does One Cost?

What Things Should First-Time Home Buyers Do to Avoid Missteps?

Now that you know what first-time home buyer mistakes to avoid, you can start planning your next moves. These tips can help you maintain financial control and make the home-buying process much easier:

1. Save as Much as Possible

Everyone knows that you need to save for a down payment on a house, but don't forget to factor in other costs. You'll need to pay closing costs to secure the sale. According to Nerd Wallet, these could add up to between 2% and 5% of your total mortgage amount. Don't forget to put money aside for moving costs and any furniture you’ll need for your new home.

It can be tempting to buy a house as soon as you've saved the minimum down payment. However, consider waiting until you've saved a larger deposit. The larger the amount you put down, the less you'll have to borrow to get your home. Having a larger deposit could also increase the number of providers prepared to lend to you, and it may help you secure a better interest rate.

2. Improve Your Credit Score

Being in debt can make it harder to afford your mortgage repayments, but it can also limit your mortgage options. A less-than-stellar credit rating can affect how many providers are willing to give you a mortgage, and you may not get the best interest rates.

Before you consider taking out a mortgage, use an online checker to find out your credit score. It may be worth waiting while you build your credit rating if it's on the lower side. Simple steps like reducing your credit card balance and paying your bills promptly can significantly improve your score.

3. Shop Around

Don't be tempted to go for the first mortgage provider you see. There are many types of mortgages to choose from, and benefits and interest rates will vary widely according to the provider. It's sensible to compare several mortgage options before making a final decision. If you're not sure how to choose the best first-time mortgage, paying for guidance from a financial advisor could save you a lot of money in the long run.

It's also important to carefully consider what kind of property you want and where you want to live before making any commitments. If you're moving out of your current area, spend plenty of time checking out the new city you're considering to see if you can picture yourself living there. Condos are often cheaper than houses, but you should consider whether you will be happy living in such close proximity to your neighbors.

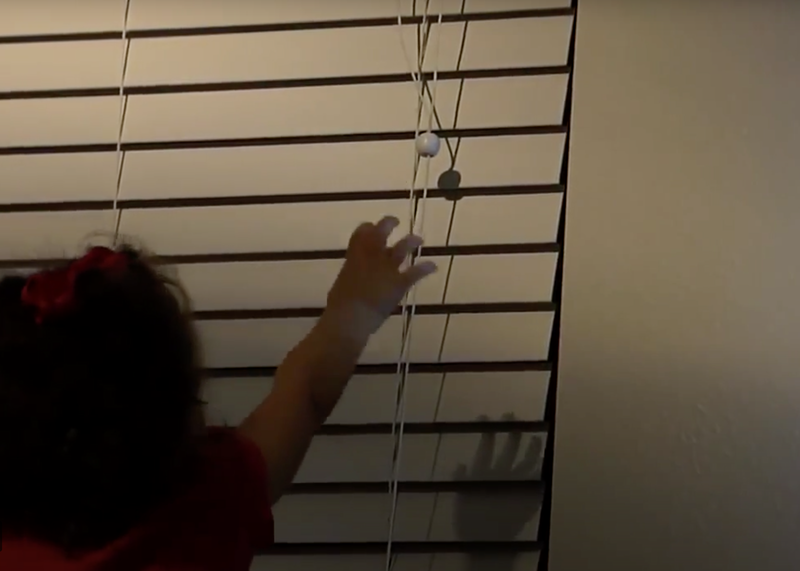

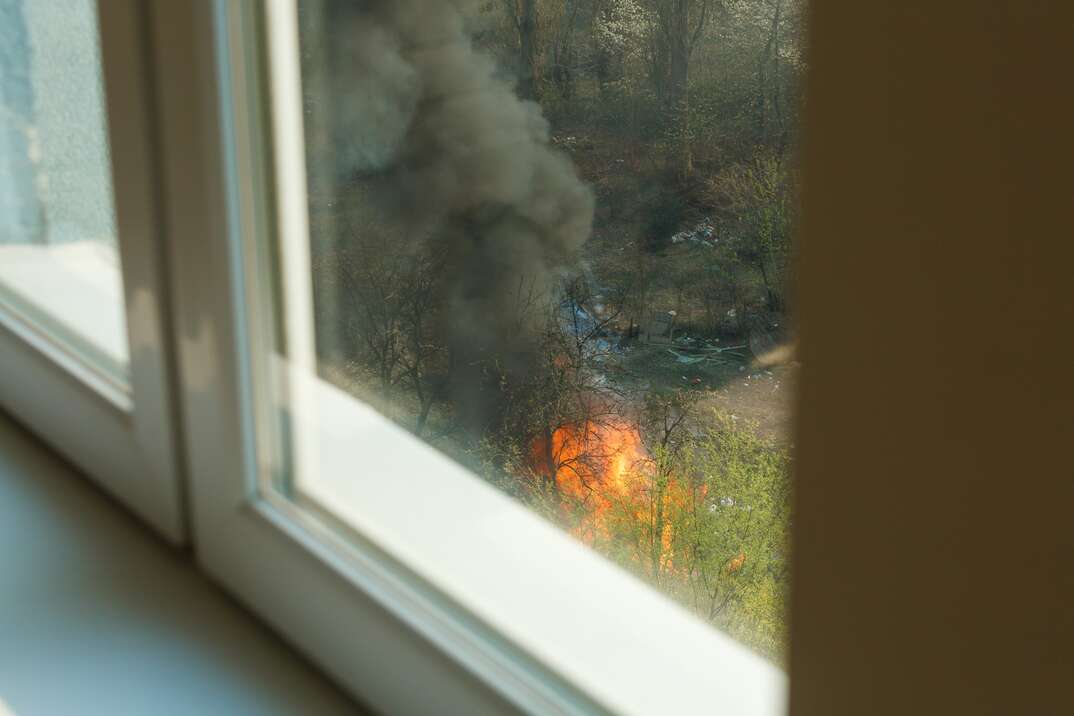

Generally, it's a good idea to view multiple properties so that you can see all the options you can afford. If the homeowners are there during viewings, don't forget to ask them about the neighborhood. If you're planning on having kids, check that any property you're considering can accommodate a growing family and that there are good amenities and schools nearby. Once you've found a property you like, arrange a home inspection to check for any serious problems before committing.