Does My College Student Need Renters Insurance?

Leaving home to attend college is an exciting time for young adults. But because it’s the first time out on their own, the experience presents a lot of uncertainties for new students. Will they make friends? Will their courses be challenging? And will they need their own renters insurance while they’re away at school?

This May Also Interest You: Homeowners Vs. Renters Insurance: What’s the Difference?

A renters insurance policy covers personal possessions in case of damage or theft, and it also includes additional liability coverage. So, do college students need it? We’ve got your answer below.

What Kind of Insurance Does a College Student Need?

This depends on their and your family's circumstances. If a student intends to live away from the family home in a rented dorm or private apartment, they may need renters insurance designed for students. This type of insurance covers their personal property and various liabilities. It doesn't cover the building structure itself, as it is the landlord's responsibility to insure the dwelling by purchasing landlord insurance.

However, college students may not need to purchase renters insurance at all if their parents own their family homes. Many homeowners policies cover college students' belongings when they're living away from home to study, but you'll probably still need to purchase liability insurance separately.

Whether your homeowners insurance covers your college student is something that varies by provider, so you should check your policy. Also, check how much coverage your homeowners policy provides students living away from home. Compare it to the value of their possessions to make sure it's adequate.

If your student will be living in a dorm, you could consider dorm insurance as an alternative. The advantage of dorm insurance is that it's usually cheaper than a renters policy and often has lower deductibles, allowing students to file claims for smaller losses. It also often covers accidental damage, unlike most renters insurance coverage. However, it doesn't include personal liability or additional living expenses coverage.

Why Should College Students Have Their Own Renters Insurance?

Purchasing renters insurance for college students is a wise move because it covers many things, like:

Personal Property

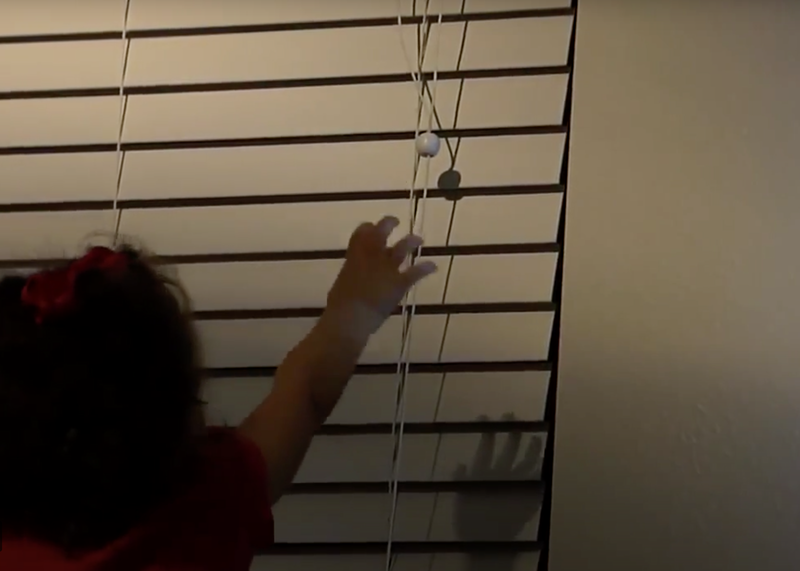

Often, the value of a college student's possessions is surprisingly high. When you inventory the cost of textbooks, clothing, technology and any furniture, the outlay to replace these items is probably unaffordable for most college students and their families. A renters insurance plan would cover the value of the student's possessions in certain circumstances, such as a fire. Bear in mind that expensive electronic items like laptops may require additional coverage.

However, it's important to look through the small print of any renters insurance policy you're considering because they vary in terms of the circumstances in which they will pay out for damage. Consider the area where the student will be renting and the most likely situations in which they might need to claim on their renters insurance. For example, a student living in a cold area should consider purchasing a policy covering ice and snow damage.

Personal Liability

A factor that college students and their parents sometimes forget to consider is personal liability coverage. Renters insurance covers the cost of legal fees and compensation to others if someone sustains an injury or damage to their property due to the student's actions.

For example, if the student hosts a party where somebody is hurt, they could be held legally liable. In this situation, their renters insurance policy will cover the costs of the claim against them.

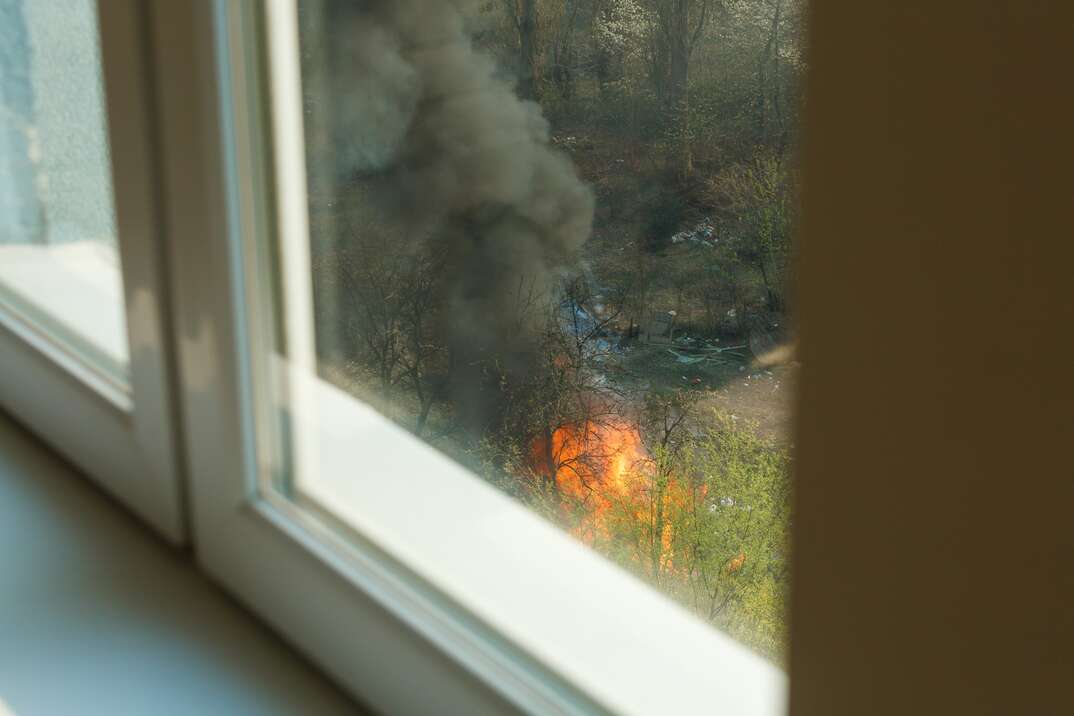

Additional Living Expenses

If the student's accommodation becomes uninhabitable — due to a fire, for example — they will need to find alternative accommodation while their dorm room or apartment is repaired. This can be expensive, and most renters insurance policies will cover reasonable additional living costs until they can move back into their home.

Medical Costs

If someone is hurt in a household incident, most renters insurance policies will cover the cost of any medical bills incurred. This includes the cost of an ambulance to a hospital, emergency room care and any ongoing treatment required as a direct result of the accident or incident.

More Related Articles:

- Decking Out the Dorm: Tips for Furnishing Your College Kid’s Home Away From Home

- Cool for School: Here Are the Top 5 Dorm Mini Fridges

- What Is Condo Insurance and What Does It Cover?

- How to Do a Home Inventory Before Disaster Strikes?

- What Does Homeowners Insurance Cover … and What Doesn’t It?

How Much Is Renters Insurance for College Students?

Fortunately, renters insurance is relatively affordable, costing $13 per month on average, according to Money Geek. Therefore, it's almost always worth investing in renters insurance for college students because it offers significant protection for a low price.

However, the costs of individual policies depend on various factors, including the payout limit and deductible. While it may be tempting to opt for the cheapest policy available, check that the coverage is adequate to cover the entire value of the student's belongings and that the deductible is affordable. You may also need to pay an additional premium on top of the basic rate to cover expensive electronic items.

Why Do Many College Students Choose Not to Purchase Renters Insurance?

One of the primary reasons many college students don't purchase renters insurance is that they simply don't know they need it. Other students don't believe that their personal belongings are valuable enough to warrant investing in an insurance policy. Some prefer to avoid the monthly fees and take their chances.

Some students also decide not to purchase renters insurance because they're intimidated by the application process or don't understand the jargon surrounding insurance policies. If the student is unsure how to select their own renters insurance policy, parents or a reputable insurance agent can help them purchase the correct coverage.

Many students don't purchase renters insurance because they really don’t need it; their parents' homeowners insurance policy covers them. However, this doesn't apply to landlord policies. Landlords insurance covers the structure itself but not the value of the tenant's belongings. Unless the damage or loss is sustained because of the landlord's negligence, the student won't have any recourse with the landlord's insurer if their property is damaged, destroyed or stolen.